The glamorous side of investing

READ FULL ARTICLE HERE

There’s no sure-fire way to succeed in finance, but some avenues are more fun than others suggests our resident expert Victoria Harris.

I love reading. Some say I’m a bit of a bookworm especially if it has anything to do with money, investing or finance. The most recent book I read was no different. Written by Morgan Housel, it was called The Psychology of Money, and I honestly couldn’t recommend it more.

What wealth really looks like

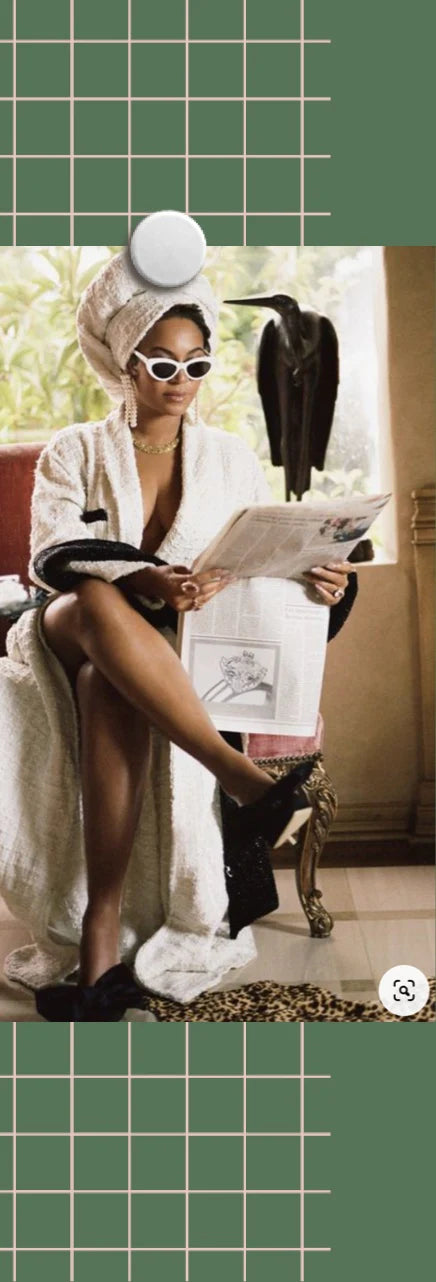

One chapter that really spoke to me was entitled, “Wealth is what you don’t see”. As I was reading this, part of me agreed, but part of me also disagreed. Let me explain… Spending money to show people how much money you have is the fastest way to have less money. Nobody can see your investment account, how much you have in your KiwiSaver or if you own shares in Apple. So we rely on our outward appearance to reflect our financial success: things like cars, homes, watches, Instagram stories.

There seems to be this whole mentally of “fake it till you make it”. But how do you “make it” when you’re spending all your money? The truth is wealth is what you don’t see. It’s the nice cars not purchased, it’s the new shoes left on the shelf and the new haircut not had. Wealth is the financial assets that haven’t been converted into the stuff you see.

It is hard for humans to think of wealth like this, as you can’t contextualise what you can’t see. The book finishes by saying, the only way to be wealthy is to not spend the money that you have. And this is where I beg to differ. Investing is all about putting money into something, anything, with the expectation that “thing” will generate a profit by increasing in value.

Yes, we are taught that if you save and invest, this is the best way to grow your wealth. But what if we could spend and grow our wealth?

The world of investing – index funds, stock exchanges, ETFs – might not be the most glamorous, but it has historically been lucrative. So too has investing in Hermès Birkin bags. In most cases, Hermès Birkin bags have a higher resale value than their initial price. According to reports, the price of some Hermès bags have outperformed other luxury items, like vintage cars, watches and art, making them a very attractive investment.How you can invest now

Looking forward, we have fears of a global recession and inflation running at a 40-year high. Investing is becoming the only hope people have of preserving the value of their money. This is where a touch of glamour could help. The average price of Birkins rose by 38% in 2021. And it’s not just Hermès people are investing in. Chanel bags rose by 12% over the same period. To put this in perspective, the NZ stock market returned 0%. I know what I’d prefer. Investing in anything comes with risks. Investing in handbags though, comes with a different set of risks. Is it authentic? Is it good quality? Is it made by a reputable brand? Make sure you do your research and invest with your eyes wide open. And for those who find investing in stocks a bore, hopefully this might be a bit more up your (shopping) alley.Words: Victoria Harris